Objective

Temporary admission allows non-EU flagged private yachts, owned by non-EU residents, to enter and operate in EU waters without paying VAT or customs duty—provided the yacht is intended for re-export.

Rules for temporary admission

-

Eligibility: Only for non-EU resident beneficial owners operating non-EU flagged private (non-commercial) vessels.

-

Duration: Temporary admission is valid for up to 18 months.

-

Free Movement: Yachts may move between EU Member States without additional customs formalities.

-

Start and End: The period begins upon entry into EU customs territory and ends upon exiting to non-EU waters.

-

Documentation: While formal customs declarations aren’t always required (e.g. in Spain), some Member States may ask for written or oral declarations. Owners/captains should keep detailed records.

-

Crew: EU-resident crew may work aboard with a valid employment contract.

-

Extension: Once the 18-month period ends, the yacht must exit EU waters. Upon re-entry, a new 18-month period begins. There is no minimum time the vessel must remain outside EU territory.

-

Residency & Use: Temporary admission is not available to beneficial owners with EU fiscal residency. Commercial use of the vessel is strictly prohibited, which may include advertising it for sale.

Note: For official EU information, visit:

Temporary Importation (European Commission)

Voluntary customs nonding

When the vessel is not in active use:

-

Suspension of the Clock: The 18-month period is paused while the yacht is bonded.

-

Duration: Bonding is allowed for up to 24 months (e.g. in the Balearics).

-

Crew Onboard: Crew may stay aboard if properly employed.

-

Temporary Debonding: Allowed for specific purposes like sea trials or moving between berths. The 18-month clock resumes afterward.

-

End of Period: Once both bonding and temporary admission periods expire, the vessel must exit EU waters or become liable for VAT and customs duties.

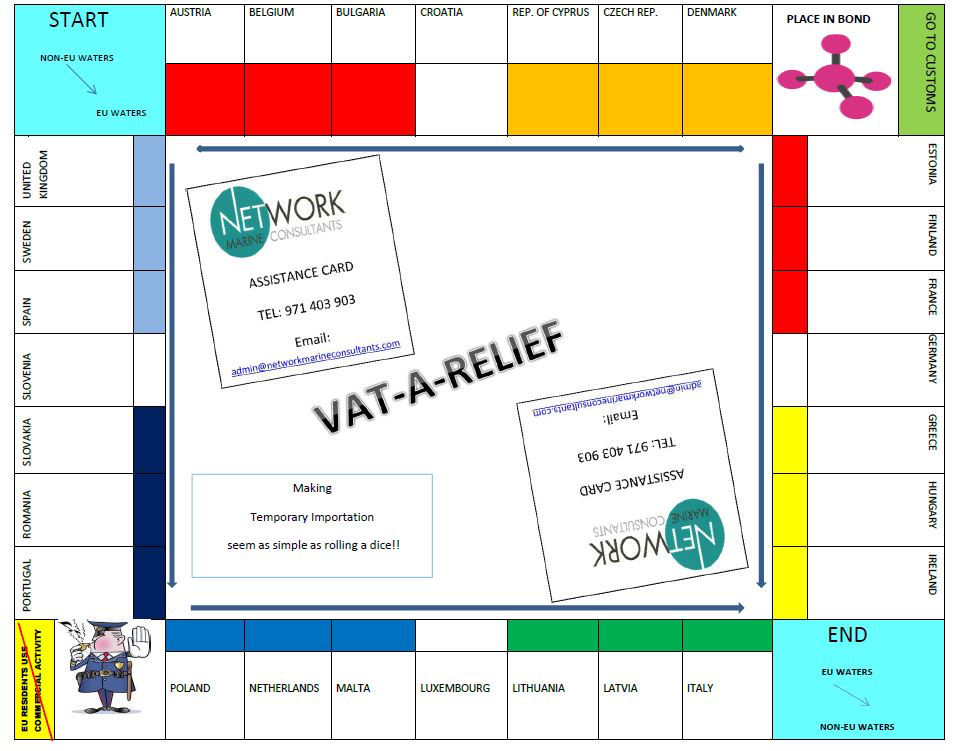

How network marine consultants can help

-

Expert guidance on temporary import procedures and customs inspections.

-

Assistance with customs bonding applications and communication with customs authorities.

-

Support for vessel re-export and VAT payment procedures if you choose to remain in the EU.

-

Tailored advice for corporate vs. individual yacht ownership documentation.

For more information or support, contact Network Marine Consultants.

0 Comments